Introduction

Decentralized Finance Explained: Decentralized Finance (DeFi) is transforming the financial landscape with innovative advancements like blockchain technology. Within the ever-evolving scene of finance, these technological progressions continually pave the way for transformative changes. One such advancement capturing the imagination of the financial world is blockchain technology and its sibling, Decentralized Finance (DeFi).

What is Decentralized Finance (DeFi)?

Decentralized Finance, or DeFi, speaks to a worldview move within the way budgetary administrations are gotten to and utilized. At its center, DeFi looks to use blockchain innovation to dispose of middlemen, empowering peer-to-peer exchanges in a trustless way. Not at all like conventional back, which depends on centralized institutions such as banks and trades, DeFi stages work independently through shrewd contracts, giving clients more noteworthy straightforwardness, security, and control over their resources.

The Foundations of DeFi

Understanding Blockchain and Smart Contracts

Blockchain, in essence, may be a dispersed record innovation that records exchanges over numerous hubs in a secure and straightforward way. Shrewd contracts, on the other hand, are self-executing contracts with the terms of the understanding straightforwardly composed into code. These two foundational components shape the spine of DeFi, empowering the consistent execution of monetary exchanges without the need for middlemen.

The Part of Blockchain in Finance

Blockchain innovation holds the potential to revolutionize the monetary industry by offering solutions to age-old challenges like fraud, inefficiency, and lack of transparency. By decentralizing control and providing permanent records of transactions, blockchain mitigates the risk of manipulation and fraud. This fosters trust within the financial system. Consequently, blockchain technology is paving the way for a more secure, transparent, and efficient financial infrastructure.

Exploring Smart Contracts: The Building Blocks of DeFi

Smart contracts, fueled by blockchain innovation, are programmable agreements that naturally execute and implement the terms of a contract. Within the domain of DeFi, smart contracts serve as the spine of decentralized applications (DApps), empowering the mechanization of different money-related forms such as loaning, borrowing, and exchanging.

Key Components of DeFi

Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are a fundamental component of the DeFi ecosystem, offering users a platform to trade cryptocurrencies directly without intermediaries. Unlike centralized exchanges, which custody users’ funds and facilitate trades through order matching, DEXs operate in a peer-to-peer manner. This allows users to maintain control of their assets at all times. As a result, DEXs promote greater security and autonomy within the crypto trading space.

Liquidity Pools and Automated Market Makers (AMMs)

Liquidity pools, a concept spearheaded by decentralized trades, permit clients to pool their resources together to encourage exchange. Automated Market Producers (AMMs) utilize these liquidity pools to empower nonstop and mechanized exchanging, dispensing with the requirement for conventional arrangers and showcase producers. This imaginative approach to advertising has democratized access to liquidity and reduced obstructions to sections for dealers.

Advantages of DEXs over Traditional Exchanges

Decentralized trades offer a few advantages over their centralized partners, including improved security, straightforwardness, and censorship resistance. By operating on a conveyed organization of hubs, DEXs are intrinsically versatile to hacking and downtime, giving clients peace of intellect knowing that their reserves are secure.

Challenges and Risks in DeFi

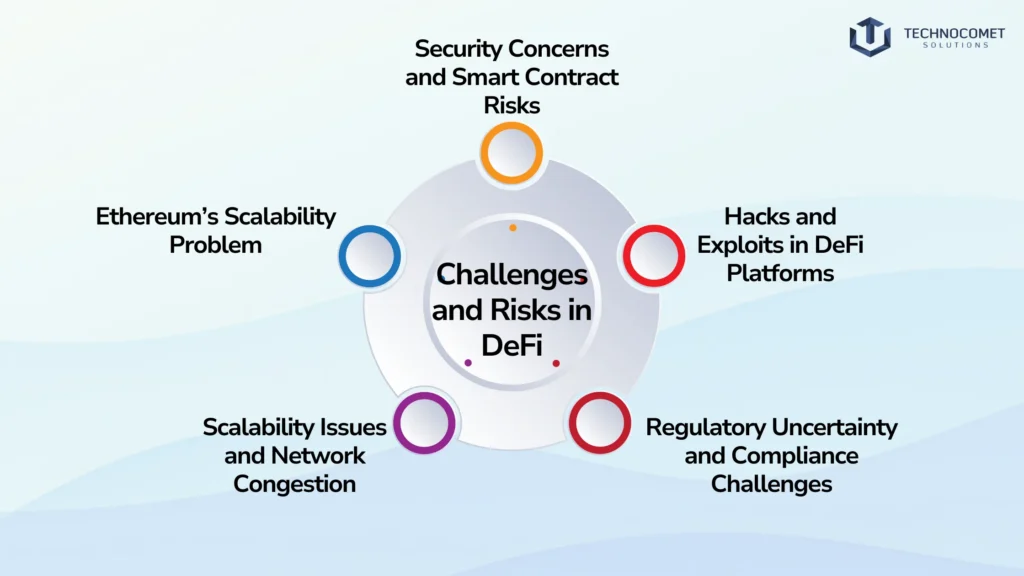

Security Concerns and Smart Contract Risks

In spite of its guarantees of transparency and security, DeFi isn’t without its dangers. Keen contract vulnerabilities, coding blunders, and abuses have driven critical losses for clients and raised questions about the security of decentralized fund stages.

Hacks and Exploits in DeFi Platforms

DeFi stages have gotten to be profitable targets for programmers and malicious actors looking to exploit vulnerabilities in smart contracts and conventions. These assaults can result in the misfortune of stores, disturbance of administrations, and harm to the notoriety of DeFi ventures.

Regulatory Uncertainty and Compliance Challenges

The regulatory landscape surrounding DeFi is still evolving, with policymakers and regulators seeking to understand and regulate this nascent industry. Regulatory uncertainty poses challenges for DeFi ventures seeking to operate within the bounds of the law while maintaining the ethos of decentralization. Navigating this uncertain terrain requires careful consideration and adaptation to changing regulatory requirements.

Scalability Issues and Network Congestion

Ethereum, the leading blockchain platform for DeFi, has faced scalability issues and network congestion. Increasing demand for decentralized finance applications has led to high gas fees and slow transaction times. These challenges have hindered the accessibility and usability of DeFi platforms. Consequently, developers are exploring alternative solutions to address these issues.

Ethereum’s Scalability Problem

Ethereum’s scalability issue stems from its plan as a proof-of-work blockchain, which limits its exchange throughput and versatility. As the ubiquity of DeFi continues to develop, Ethereum’s organized blockage has ended up being a critical bottleneck, ruining its capacity to support mass selection.

The Future of DeFi

Interoperability and Cross-Chain Solutions

Interoperability and cross-chain arrangements are poised to play a pivotal role in the future of DeFi. They bridge different blockchain systems, enabling seamless asset exchanges between them. Ventures like Polkadot, Cosmos, and Chainlink spearhead cross-chain interoperability protocols. These initiatives pave the way for a more interconnected and interoperable DeFi ecosystem.

Bridging Different Blockchain Networks

Bridging diverse blockchain systems empowers clients to utilize the unique features and capabilities of different blockchains. This expands the scope and usefulness of DeFi applications. Interoperability solutions break down the silos between blockchain systems, opening new opportunities for innovation and collaboration within the decentralized finance space. By enabling seamless communication and interaction between various blockchains, interoperability fosters a more interconnected and efficient ecosystem. This fosters greater accessibility and inclusivity, driving the evolution and adoption of DeFi on a broader scale.

The Impact of Institutional Investment on DeFi Growth

The convergence of regulatory ventures into DeFi is expected to fuel its growth and advancement, bringing liquidity, validity, and stability to the ecosystem. Regulatory players bring institutional-grade infrastructure, risk management practices, and compliance standards critical for the maturation and sustainability of DeFi. This involvement signals a significant step towards mainstream adoption and acceptance of decentralized finance. It also underscores the importance of establishing trust and credibility within the DeFi space.

Conclusion

Reflecting on the advancement of DeFi and its impact on the financial landscape, we witness a worldview shift in how value is created, exchanged, and managed. Looking ahead, the future of DeFi presents opportunities and challenges as we navigate toward a more decentralized, transparent, and inclusive financial framework.

Explore the DeFi revolution in our blog. Partner with TechnoComet Solutions for expert IT services tailored to your needs. Whether integrating blockchain or optimizing digital infrastructure, we’re here to help. Contact us today!

FAQs

DeFi, short for Decentralized Finance, refers to a revolutionary financial system built on blockchain technology, that enables peer-to-peer transactions without the need for traditional intermediaries like banks.

Unlike traditional finance, which relies on centralized institutions and intermediaries, DeFi operates autonomously through smart contracts, providing users with greater control, transparency, and accessibility to financial services.

Some of the risks associated with DeFi include smart contract vulnerabilities, hacking attacks, regulatory uncertainty, and scalability issues. It’s essential for users to conduct thorough research and exercise caution when participating in DeFi platforms.

DeFi offers several benefits, including financial inclusivity, lower fees, faster transactions, and greater transparency. It empowers individuals to access financial services, earn passive income, and participate in the global economy, regardless of their geographical location or socioeconomic status.