Introduction

AI in Finance sector is revolutionizing the financial services industry, offering innovative solutions that are reshaping the future of banking and finance. As AI continues to evolve, it is becoming an integral part of the financial ecosystem, driving efficiency, enhancing customer experience, and transforming the way financial institutions operate.

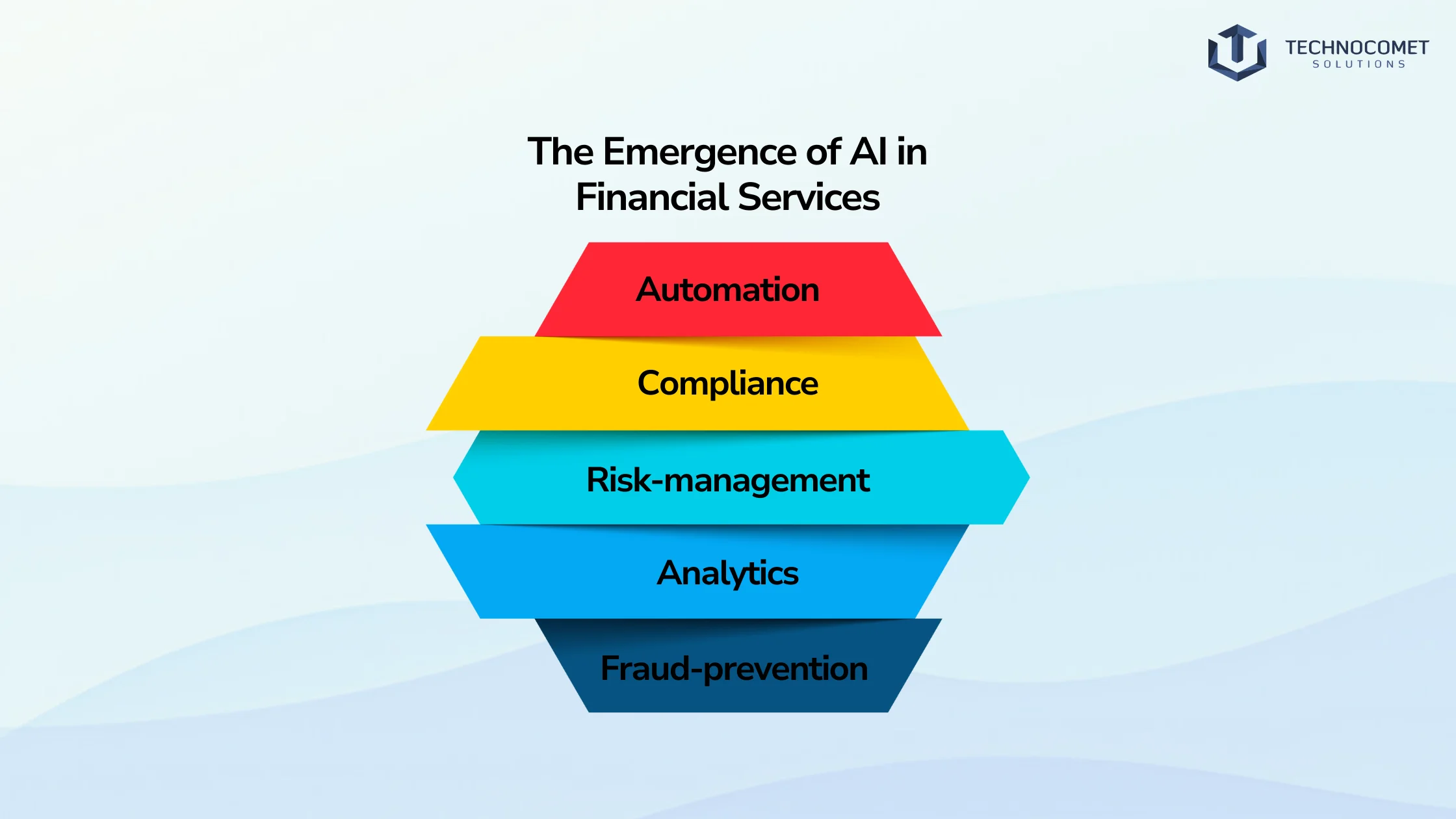

The Emergence of AI in Financial Services

The integration of AI in the finance sector has been a game-changer, enabling financial institutions to streamline processes, make data-driven decisions, and stay ahead of the competition. From automating routine tasks to providing personalized financial advice, AI is transforming the way the finance sector operates.

One of the key areas where AI is making a significant impact is risk management and compliance. AI-powered risk assessment models help financial institutions identify potential risks more accurately, while predictive analytics detect and prevent fraud. Additionally, AI streamlines compliance processes by automating regulatory monitoring and reporting.

Revolutionizing Customer Service

AI is also revolutionizing customer service in the finance sector. AI chatbots and virtual assistants are becoming increasingly common in banking, providing customers with instant access to information and support. These AI-powered solutions are not only improving customer experience but also reducing the workload for human customer service representatives.

Moreover, AI is being used to provide personalized financial advice to customers. By analyzing individual financial data and preferences, AI algorithms can create customized investment plans and offer tailored financial advice. This level of personalization is helping financial institutions build stronger relationships with their customers and improve customer loyalty.

Optimizing Investment Strategies

AI is also transforming the way financial institutions approach investment strategies. Algorithmic trading, which uses AI-driven market analysis, is becoming increasingly popular in the finance sector. AI algorithms can analyze vast amounts of data, identify patterns, and make trading decisions at a speed and scale that would be impossible for human traders.

AI is also being used in portfolio management to create customized investment plans for individual investors. By analyzing a client’s financial goals, risk tolerance, and investment preferences, AI algorithms can create a portfolio that is tailored to their specific needs. This level of customization is helping financial institutions provide more effective investment solutions to their clients.

Transforming Lending and Credit Scoring

AI is also making a significant impact on lending and credit scoring. AI algorithms are being used to assess credit risk more accurately, taking into account a wider range of factors than traditional credit scoring methods. This is helping financial institutions make more informed lending decisions and reduce the risk of default.

AI is also being used to automate loan processing, reducing the time and effort required to process loan applications. By using AI to analyze loan applications and supporting documents, financial institutions can make faster and more accurate lending decisions, improving the customer experience and reducing the workload for loan officers.

Improving Operational Efficiency

Finally, AI is helping to improve operational efficiency in the finance sector. By automating routine financial tasks such as data entry and reconciliation, AI is reducing the workload for finance professionals and improving the accuracy of financial data.

AI enhances financial forecasting and planning, helping financial institutions make more informed decisions about resource allocation and investment. In addition to these benefits, AI streamlines back-office operations in the finance sector. By automating processes such as document management and workflow, AI is helping financial institutions reduce costs, improve efficiency, and free up resources for other strategic initiatives.

Conclusion

The impact of AI on the finance sector cannot be overstated. As AI continues to evolve and mature, we will likely see even more transformative changes in the way financial institutions operate. From enhancing risk management and compliance to revolutionizing customer service and optimizing investment strategies, AI is poised to play a critical role in shaping the future of the finance sector.

If your finance company is looking to harness the power of AI to drive innovation and stay ahead of the competition, consider partnering with TechnoComet Solutions. Contact us today!

FAQs

AI is revolutionizing lending by automating credit risk assessment and loan processing. This enables lenders to make faster, more informed decisions while reducing the risk of default.

AI offers enhanced risk management, improved customer service, optimized investment strategies, and increased operational efficiency. AI-powered solutions are driving innovation across the finance sector.

AI is transforming portfolio management by enabling more data-driven decision-making. Algorithmic trading and customized investment plans are being powered by AI’s ability to analyze vast amounts of data.

Ensuring the ethical use of AI, investing in necessary infrastructure and talent, and addressing concerns around job security are some of the key challenges in implementing AI in the finance sector.